Archive for category Installed Seats

UK Survey Projects 50% Increase in BIM usage in 2011 : + BIM UK Marketshare

Posted by Jim Foster in Adoption, BIM, Installed Base, Installed Seats on December 8, 2010

“The majority of the market is far from ready, but accepts the inevitability of a BIM future.” This on the “Conclusions” slide of Dr. Stephen Hamil, Head of BIM for NBS (National Building Standards), presentation. While the study as pointed out by Anna Winston on BD Online

(The) survey launched by standards and specifications expert NBS has revealed an ‘alarming lack of awareness’ of BIM across the construction industry.

The survey of 386 construction professionals, including 155 architects,showed that 43% were either unaware of or hadn’t used Building Information Modeling (BIM)

So mostly we are dealing with 57% of the total, however, more importantly from those respondents, 31% of those used BIM to a degree, but within the next year that figure doubled to 62% and within 3 years a whopping 82% expected to be working with BIM. And don’t tell me that 43% that did not know about BIM stays static. Especially, not when Paul Morell Chief Government Construction Advisor has already stated that he plans to bring BIM into the public procurement process.

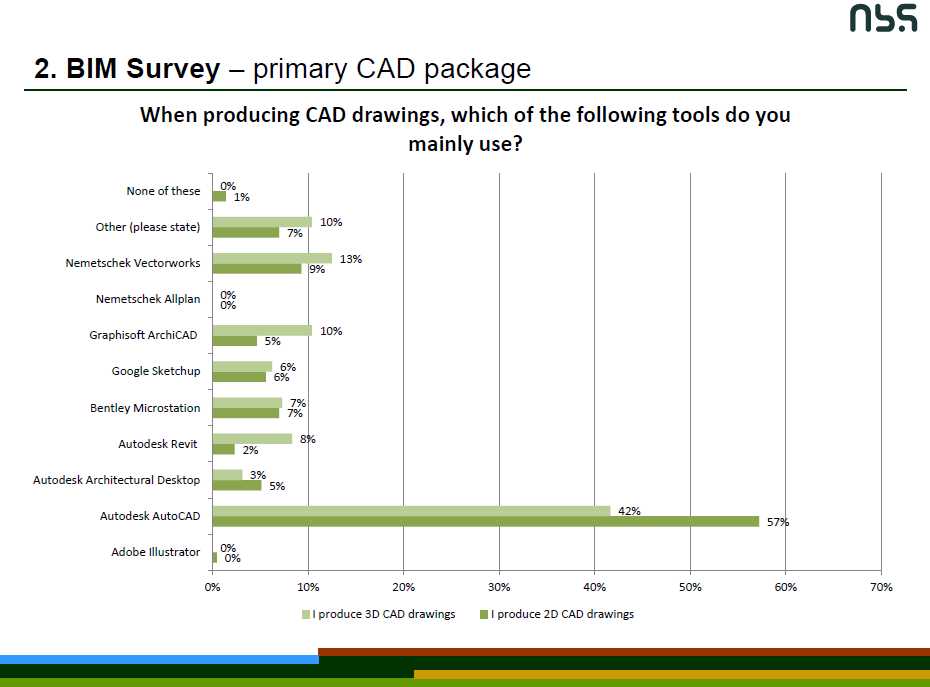

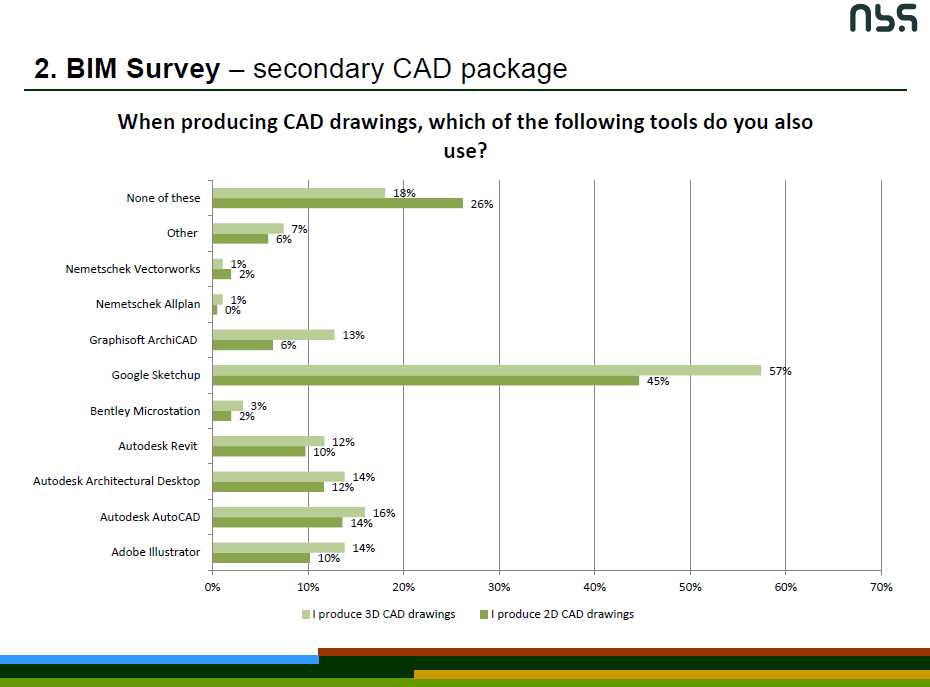

Looks like a big BIM BOOM, and if so, let’s look at who is using which BIM authoring package which was also broken down by the NBS Survey.

You’ll see that Vectorworks at 13% and Archicad at 10% take up almost 1/4 of the market. Revit is at 8% and its second cousin ADT is at 3% (did they not get the memo its now ACA or Autocad Architecture.) However, more telling is SketchUP at 6% and AutoCAD at 42%. This is all for producing 3D drawings. I would think that Autodesk will push the bundling of AutoCAD and Revit hard in order to further their penetration. However, look at the chart below and you see that as a secondary package 57% are using SketchUp. Yoinks. Maybe just because its free, or its excelling at visual communication but it would seem to me that Google can leverage that position to get users on the Professional Version, or perhaps something else? But understand that it was included in the BIM conversation.

CAD Market / BIM Market 2010 : Installed Base : Ouch.

Posted by Jim Foster in 3D, Autodesk, BIM, economic trends, Installed Seats on May 6, 2010

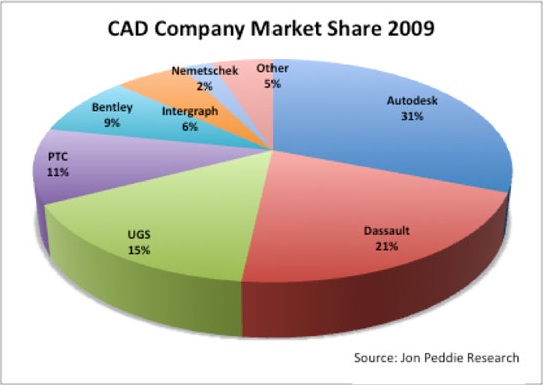

So earlier in these ruminations I stated that I thought 30% less was the new watermark, that is, 30% less work out there, 30% off what used to be a winning bid. Early market data from Jon Peddie Research, shows a 22% drop in 2009 CAD revenues as compared to 2010. This is just on the software side, not services, which we can argue would be worse. Subscriptions are down because why renew an empty seat as are new sales. This report deals with CAD on all levels from designing parts to designing buildings but still gives a good overview of the industry. The good news for those embracing BIM is that they reaffirm other anecdotal information that BIM is a bottom up phenomena not a mandate from management. That is, the people building the buildings are the ones who are using not because of perceived value or marketing spin but because it adds value. Hammer..check…Compressor…check…BIM model…

Updated Aug 2010

I noticed a lot of traffic to this page, and also noticed that the link to the report required a log in so decided to quote it here.

Let’s just get this over with: the year 2009 was a disaster in the CAD industry. According to our latest report, the CAD industry saw revenues of $5.1 billion, a 22% drop compared to 2008 and although the picture is improving for 2010, there is no rebound because that’s just not the way the CAD industry works, and worse, that’s not how this recession worked.

The CAD industry cannot turn on a dime because it’s part of larger systems. At this year’s Autodesk University, Carl Bass noted that subscriptions were down because there’s not much reason to maintain a subscription for empty seats. Unfortunately, there are a lot of empty seats for all CAD systems worldwide. We estimate that approximately 200,000 workers left the CAD industry worldwide. And, it can be added, we believe this is a conservative view.

In this latest report we have seen an interesting trend as Building Information Modeling (BIM) becomes accepted in the engineering, architecture and construction (AEC) industry. The similar discipline, PLM is just about ubiquitous in MCAD but as it was being introduced into the MCAD industry in the early 90s, it was essentially implemented in a top-down process as management signed up for the advantages that come with a consistent and connected data pipeline. In contrast, BIM in the architectural fields is being driven by those at the end of the pipeline in building and construction.

Autodesk: User Upgrades : How many people actually do it : #BIM

Posted by Jim Foster in Autodesk, Installed Base, Installed Seats, Revit on November 10, 2009

I do not claim to be an analyst or play one on TV, however, I am interested in what is happening in this space from a business perspective and when I try to get clean answers on the question I am asking I find it is not always easy. So my most recent query was to find out how many people or percentage of users actually upgrade? Or start using the new stuff when it comes out. As a software developer you want the needle pinned at 100%, as a user, I admit that I still fire up programs that have the ’05’ in the title. Yeah that’s a long winded intro, but this is what pulled from Autodesk and my interpretation of it.

Using Autodesk FY 2010 as a guideline.

Combined q1 and q2

Total Revenue – $841 Million

License and Other Revenue – $477

Maintenance – $ 366

Upgrade – $70 Million

On a percentage basis Maintenance Revenue is at 44%, Upgrade Revenue is roughly 8%.

So at any one time at least 50% of Autodesk’s installed base is either using or has the opportunity to use the latest software. I say the opportunity to use because if you are on a maintenance program that includes the latest releases it is highly unlikely that every organization would upgrade the software every year. Rather they made a decision that it costs less to be on the maintenance program and have the upgrade option even if they only do it every other year, etc. So sell it once and turn 1/2 your user base into an annuity.

I also know Autodesk has a lot of interest in creating the software sales model into subscription only, making that figure 100%. However, that sounds a lot like putting a lot of bees in a jar and shaking it. Better make sure that lid stays put.

CAD Marketshare : BIM Marketshare : Installed Seats : Installed Base : #BIM #CAD

Posted by Jim Foster in 3D, BIM, CAD, economic trends, Installed Base, Installed Seats, Revit on October 22, 2009

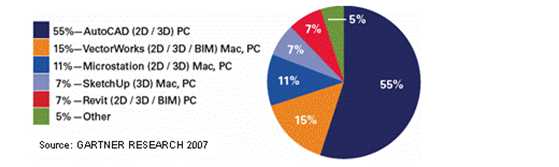

I thought I’d share some numbers here since I find it difficult to find them openly out there on the interweb. I included a Market Share Pie Chart which appears to be from Gartner Research circa 2007. Using the 55% AutoCAD figure for the total market share and using the AutoCAD installed base via 2008 of 4,162,000, which is right from an Autodesk Press release, we then can approximate the total installed seats for CAD (2D, 3D, BIM) to be around 7,567,273. However, this figure could be derived by revenue which will distort the total installed seats figure.

If we assume that 7,567,723 figure is correct, as well as the 7% figure for Revit provided by Gartner we get installed seats of Revit to be 530,000, give or take. That seems kind of close to the back of the envelope estimates I was coming up with by getting published accounts of installed Revit seats to be around 400,000 end of 2008, and they were selling new seats of Revit at around 20,000 per quarter, would have them around 480,000+ by the end of this year 2009. If installed seats of Revit have not surpassed the installed seats of AutoCAD Architecture, previously Architectural Desktop, it has to be getting close, as of 2008 there was an installed base of ADT/ACA of 503,000.

Using the report as a guideline they had BIM growth at approximately 12%, if Revit is adding seats at approximately 20,000 per quarter that is a 15% gain from FY 2009. In 2008 they had an increase in revenue from Revit from the previous year of 23%, which could be attributed to sales of subscriptions and on going maintenance contracts above and beyond the 15% I came up with here.

Another interesting fact is that as a percentage of revenue 3D Products and AutoCAD itself were getting very close to parity, with AutoCAD and AutoCADLT at 32% and 3D Products at 30%. I am not privy to how they break out all the figures but Civil 3D, Navisworks and Revit are all thrown into that bucket. So 3D solutions has gone from 23% of FY 2008 revenue to 27% of FY 2009 revenue to 30% at the Q2 FY 2010 watermark.

Some other information I found in an article at Architosh, and I have posted some of it here.

Revenue and Growth

According to JPR’s research, CAD software vendors saw combined revenues of $5.2 billion (USD) in 2007 globally. The CAD software market grew by an astounding 20% in 2007 compared to 2006. Despite a very poor US economy and the threat of US recession, the CAD industry will continue its positive economic trend and will grow to over $6 billion (USD) in 2008. Looking out five years the global CAD software market will reach and exceed $8.2 billion (USD).

2D and 3D

In 2007 the worldwide installed base of CAD users reached 5.31 million. In 2007 the majority of CAD users (63%) are still working in 2D, while 37% work in 3D. However, revenues for 3D CAD surpassed 2D CAD taking 53% of the market. This trend will continue but JPR makes note that not all 2D CAD users will make a transition to 3D CAD.

The article was based on the research from Jon Peddie Research.

To look at the 2007 figure of installed seats as reported by Jon Peddie, of 5.3 Million and a 15% Growth Rate we would get approximately 6.09 Million Users in 2008 and 7.00 Million in 2009.

Hope this was helpful for those of you at their searching for this stuff, and if you weren’t I don’t know how you got here and why you’re still reading.